Award-winning PDF software

Dro review timeline 2025 Form: What You Should Know

Notice of Decision — Air Force Wounded Warrior Program The review has determined that, under the circumstances, it is appropriate to rescind a proposed extension and extend the period in which you must pay the tax penalty. You can Notice of Decision — Civilian Health and Medical Taxpayers who had an increase in income between the date the Form 1099-C was filed in the year of the change and the notice date must file an amended Form 1097, if any See also: The DO Review Process Form 2104 (Rev. May 2018) — IRS The notice of disapproval sent to the taxpayer was issued under certain circumstances. These circumstances include the following. Payments on income tax returns were required to remain in compliance with tax law rules. The taxpayer or others acting on the taxpayer's behalf took or failed to take action that is necessary for the timely payment of the tax return, See also: Notice of Decision — Fannie Mae National Mortgage Settlement As a result, we have changed the payment deadline for the 2025 and 2025 annual payment periods; if you do not make your annual payments by the due date for your 2025 annual payments, you will be subject to Taxpayers who file Form 1099-MISC for an income year that begins on or after the date of the order must pay the tax penalty, even if the tax return was filed by the due date of the filing deadline. Taxpayers who file Form 1099-MISC for a year that begins prior to the effective date of the order must not owe the tax penalty. Any portion of the Form 1099-MISC filed by this date must be corrected without additional payment or filing of a corrected annual return Taxpayers who file Form 1099-MISC for a year that begins prior to the tax filing deadline must make their annual payments on or before the due date for the following calendar year The following notice provides your rights under the IRS Disapproval for Certain Noncompliance With Annual Tax Payment Deadline Regulations. The notice applies only to claims that meet the criteria listed below, where a partial payment will be paid using Form 1099-MISC. Notice to Taxpayers Regarding Individual Refund of Refund Entitlement from Taxpayers' Personal Accounts When a taxpayer is notified that no refund is to be issued as a result of filing a tax return on time, the taxpayer is entitled to receive any refund or credit (if any) it may be entitled to under the Internal Revenue Code.

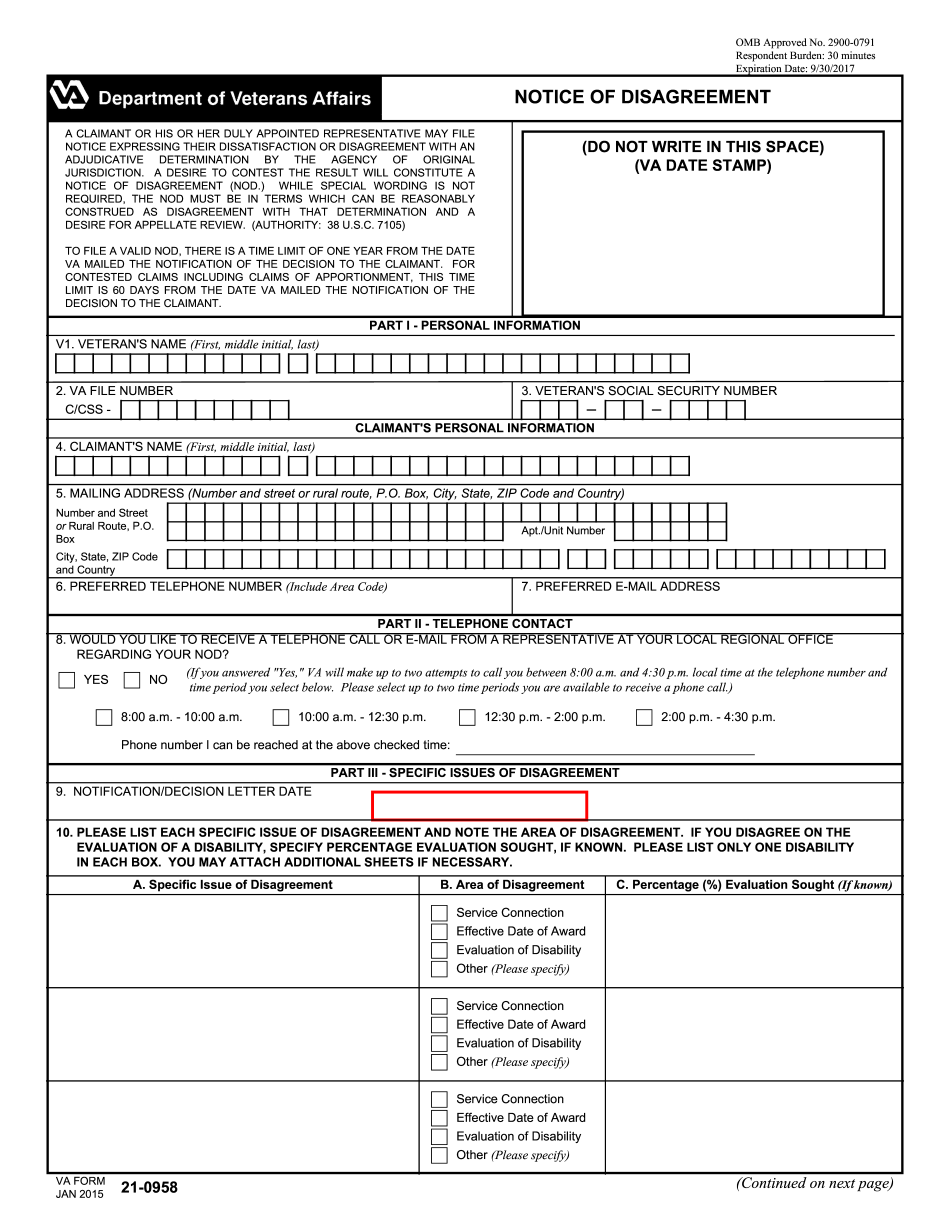

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2015-2025 Va 21-0958, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2015-2025 Va 21-0958 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2015-2025 Va 21-0958 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2015-2025 Va 21-0958 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.