Award-winning PDF software

Can i file a Notice Of Disagreement on ebenefits Form: What You Should Know

Chapters 14, 17, and 18 Decision Letters Appeal to the Board, complete VA Form 10180, Decision Review Request — Board Appeal (Notice of Disagreement). Chapters 35, 36, and 37 Decision Letters Appeal to the Board, complete VA Form 10181, Decision Review Request — Board Appeal (Notice of Disagreement). Service Accommodations for a VA Disability Pension — Your Rights A VA disability pension is designed so that an employee's service has not adversely affected his/her health or life, and the VA disability pension is meant to compensate that employee for the expected effect on his or her health and life that an employee's service would have if he or she had remained on the job with a reasonable expectation of being able to return to work in a reasonable period of time. You are entitled to one disability pension for every year in your service, even if your service was interrupted because of injury or illness. For example, if you were injured and lost your job for a few months, you might not receive a disability pension, but you would have received a disability benefit if your service had been continuous for an undetermined number of years. Service interruptions, including the layoff and relocation of members of a service due to combat operations, can often increase an employee's income at the time of service interruption. Because disability pension amounts vary by region, the amount of the disability pension you are eligible to receive is based on the actual amount of your disability compensation. If you think you might have served for a very long period and that your service will not be affected by a disability pension, there are several steps you can take to avoid this problem. First and foremost, consider the fact that the amount of your disability benefit is usually based on the average of your service prior to your disability pension. Since your service has likely been interrupted, it's possible that your actual disability compensation may decrease as additional service is taken into account. The second step is to consider the fact that the VA disability pension is taxable income and must be declared on Schedule A of your tax return. Thus, if you have not previously paid income taxes on retirement, you must have income taxes taken out through withholding and pay them by the due date. For more information or to discuss your disability compensation or your pension, contact the nearest Veteran Health Administration (VIA) Office.

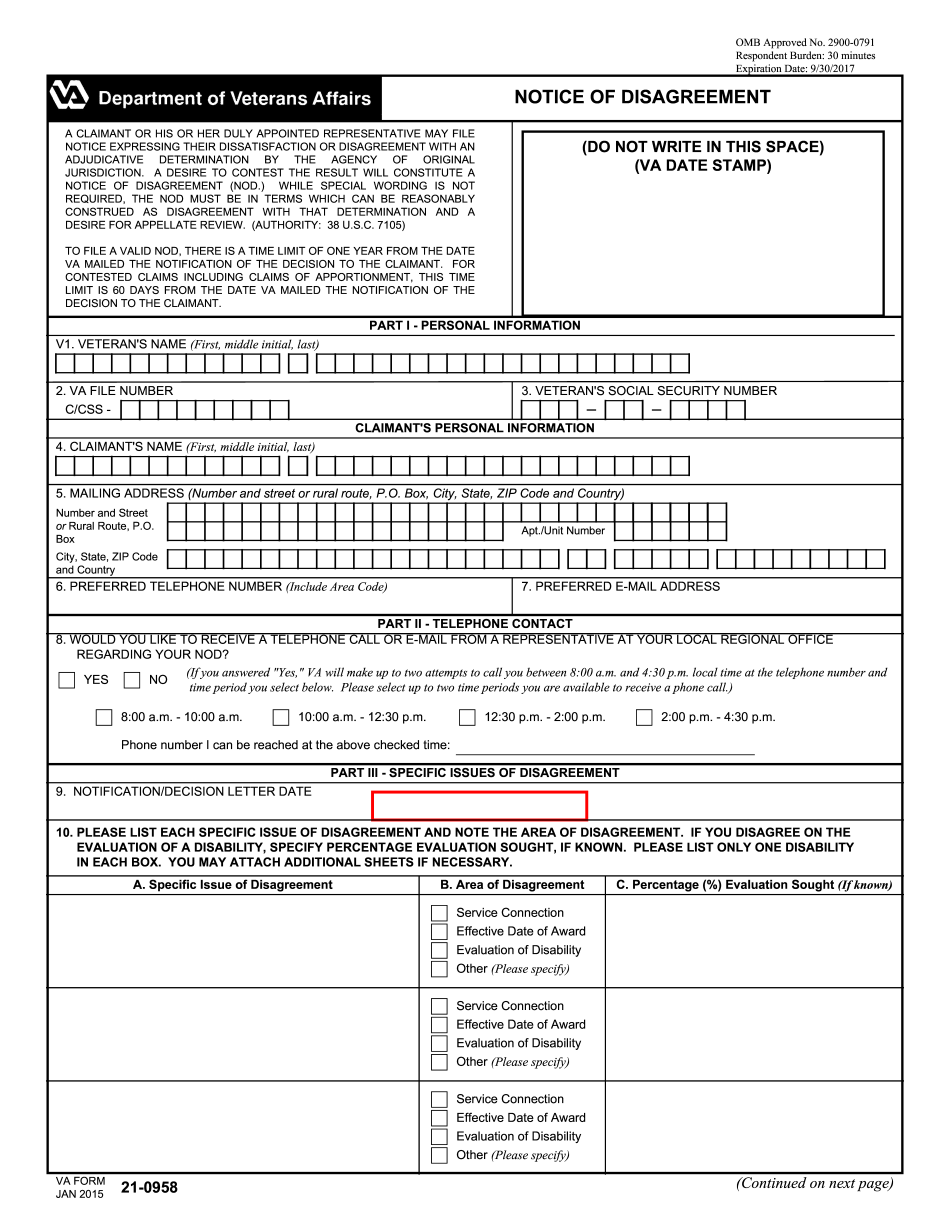

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2015-2025 Va 21-0958, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2015-2025 Va 21-0958 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2015-2025 Va 21-0958 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2015-2025 Va 21-0958 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.